<!-- Google tag (gtag.js) --> <script async src="https://www.googletagmanager.com/gtag/js?id=G-FNVKYB7G4T"></script> <script> window.dataLayer = window.dataLayer || []; function gtag(){dataLayer.push(arguments);} gtag('js', new Date()); gtag('config', 'G-FNVKYB7G4T'); </script>

Dreaming of a sleek ride in the heart of the UAE? Whether you crave the luxury of a Lexus or the practicality of a Toyota, Car Finance Dubai can make that dream a reality. In a city where mobility equals opportunity, understanding the right financing options is crucial. This guide offers a comprehensive look into how you can secure your car through smart, safe, and flexible financial options—tailored for expats and residents alike. Car Finance Dubai is not just about driving; it’s about financial freedom.

Table of Contents

Why Car Finance is Popular in Dubai

Dubai is built for the car. With its vast highways, limited public transport options in certain areas, and a fast-paced lifestyle, owning a vehicle is often a necessity. But the upfront costs can be high.

This is where Car Finance Dubai options become highly attractive. They allow individuals to:

- Drive now, pay later

- Preserve cash flow

- Get flexible terms from trusted Finance Companies in Dubai

- Build or improve credit scores

With Car Finance Dubai, residents gain the advantage of affordable ownership without immediate financial burden. It’s a crucial tool in effective Financial Planning in Dubai.

Understanding Car Finance in Dubai

Car Finance Dubai means borrowing money from a financial institution to purchase a car and repaying it over time with interest.

Types of Car Finance Options in Dubai

- Bank Loans – Offered by top Finance Companies in Dubai, these are secured loans with low interest rates.

- Dealer Finance – Convenient but may carry hidden fees.

- Islamic Finance – Sharia-compliant, interest-free options for those seeking ethical financing.

- Leasing – Ideal for short-term stays or those who prefer driving new models.

Comparison Table: Popular Car Finance Options in Dubai

| Finance Type | Interest Rate | Tenure | Eligibility | Pros | Cons |

|---|---|---|---|---|---|

| Bank Loan | 2.5% – 4.5% | 1 – 5 years | Salary > AED 5,000 | Low interest, trusted | Processing time |

| Dealer Financing | 4.0% – 6.5% | 1 – 4 years | Minimal documents | Fast, flexible | Higher interest rates |

| Islamic Financing | 0% (Profit) | 1 – 5 years | Based on Murabaha model | Sharia-compliant | Limited to specific banks |

| Leasing | N/A | 1 – 3 years | Valid UAE residency | No ownership risks | No asset ownership |

7 Smart Steps to Get Car Finance in Dubai

- Assess Your Budget: Know your income, expenses, and how much you can pay monthly.

- Choose the Right Vehicle: Match your needs with the type of vehicle.

- Compare Finance Companies in Dubai: Look at interest rates, processing fees, and tenure options.

- Check Eligibility: Most lenders require a minimum salary and UAE residency.

- Gather Documents: Emirates ID, salary certificate, bank statements, and a valid driving license.

- Apply and Get Approved: Choose your lender, submit documents, and get approval.

- Sign and Drive: Complete paperwork, make a down payment, and get your keys!

Following these steps ensures a smooth Car Finance Dubai experience. The city offers a wide range of flexible and customizable options that cater to different financial needs.

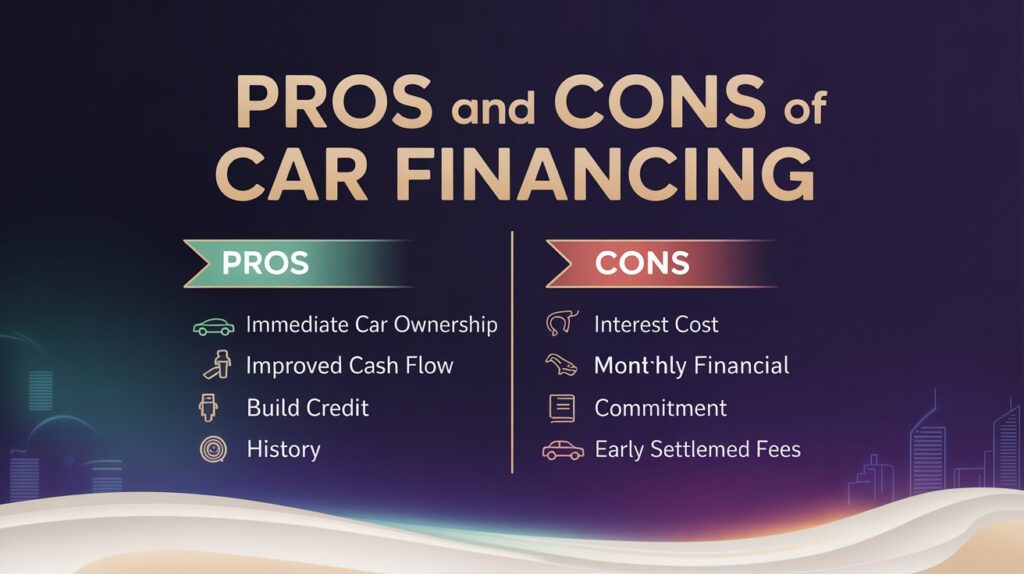

Pros and Cons of Car Financing

Pros:

- Immediate car ownership

- Improved cash flow

- Build credit history

Cons:

- Interest cost over time

- Monthly financial commitment

- Early settlement fees

Car Finance Dubai balances these pros and cons efficiently, making it a popular solution for middle-income families and expats. When combined with sound Financial Planning in Dubai, it becomes even more beneficial.

Common Terms You Should Know

- Down Payment: Usually 20% of the car’s value.

- Flat Rate vs Reducing Rate: Understand how interest is calculated.

- Insurance Requirement: Comprehensive insurance is often mandatory.

Tips for Choosing the Best Car Finance Option

Do:

- Compare 3-4 lenders

- Read the fine print

- Ask about hidden charges

Don’t:

- Focus only on monthly payments

- Ignore early settlement clauses

- Skip reading the insurance policy

If you follow these best practices, your Car Finance Dubai decision will be informed and secure.

Real Experiences from Dubai Residents

“Bricks Consultancy helped me find the right finance plan for my Nissan Patrol. The process was smooth and saved me time.” – Rahul S., Indian Expact

“Thanks to flexible leasing, I could drive a new car every two years. Great option for short-term expats.” – Anna B., German Resident

“Islamic car finance through a local bank aligned with my personal values and budget.” – Ahmed M., Emirati Entrepreneur

Many people who opted for Car Finance Dubai say it transformed how they manage finances while enjoying the benefits of car ownership.

FAQ: Car Finance Dubai

1. How much down payment is required for car finance in Dubai?

Most lenders require a minimum down payment of 20% of the car’s value when applying for Car Finance Dubai.

2. Can I get car finance with a low salary?

Yes, but it depends on the lender. Many Car Finance Dubai options require a minimum salary of AED 5,000/month.

3. Is Islamic car finance available in Dubai?

Yes, it is offered by major banks and follows a profit-sharing model. It’s one of the ethical ways to apply for Car Finance Dubai.

4. What documents are needed for car finance?

You’ll need your Emirates ID, passport, driving license, salary certificate, and bank statements to complete your Car Finance Dubai application.

5. Can non-residents apply for car finance?

No, you must be a UAE resident with a valid visa and Emirates ID to qualify for Car Finance Dubai.

Related Insights (People Also Search For)

- Auto Loan in Dubai

- Best Car Leasing Companies in UAE

- Car Insurance in Dubai

- Financial Planning in Dubai

- Used Car Loan in Dubai

- Finance Companies in Dubai

Conclusion

Whether you’re a resident or new expat, navigating Car Finance Dubai doesn’t have to be overwhelming. From bank loans to Sharia-compliant options, there’s a financial path that fits your lifestyle and budget. Smart planning, document readiness, and expert consultation are the keys to unlocking your dream car.

Take the next step today—connect with a trusted consultant and make your drive in Dubai a reality. It’s not just about the destination; it’s how you get there.

Explore your car finance options now and experience the ease of Financial Planning in Dubai with help from trusted Finance Companies in Dubai. The future of smart car ownership starts with Car Finance Dubai.