<!-- Google tag (gtag.js) --> <script async src="https://www.googletagmanager.com/gtag/js?id=G-FNVKYB7G4T"></script> <script> window.dataLayer = window.dataLayer || []; function gtag(){dataLayer.push(arguments);} gtag('js', new Date()); gtag('config', 'G-FNVKYB7G4T'); </script>

Understanding SBI Mutual Fund

SBI Mutual Fund is one of India’s most trusted mutual fund houses, offering a wide range of investment schemes tailored to meet various financial goals. Launched in 1987, SBI Mutual Fund is a joint venture between the State Bank of India and Amundi Asset Management, a European investment giant. Over the decades, SBI Funds has gained investor confidence due to its transparent operations, consistent performance, and investor-centric approach.

In this detailed article, we will explore what makes SBI Mutual Fund a strong investment option in 2025, its benefits, types of funds, how to invest, and comparisons with Mutual Funds in UAE and Mutual Investment Fund strategies. We’ll also explain how SBI Mutual-Fund fits into long-term wealth-building plans, both for Indian residents and NRIs.

Table of Contents

What is SBI Mutual Fund?

SBI Investment Schemes refers to a range of investment schemes managed by SBI Funds Management Pvt. Ltd. It includes equity funds, debt funds, hybrid funds, index funds, and tax-saving funds (ELSS). These schemes pool money from investors and invest in various securities like stocks, bonds, and money market instruments.

Why Choose SBI Mutual Fund? (7 Reasons)

Here are the top benefits that make SBI Fund a preferred choice:

| Benefit | Description |

|---|---|

| Trusted Brand | Backed by SBI, India’s largest public sector bank |

| Consistent Performance | Strong historical returns across categories |

| Global Expertise | Partnership with Amundi brings global insights |

| Wide Variety | Equity, debt, hybrid, index, and ELSS funds available |

| Professional Management | Managed by skilled fund managers |

| Investor Education | Provides tools, SIP calculators, webinars |

| Tax Benefits | ELSS funds offer up to ₹1.5 lakh deduction under Section 80C |

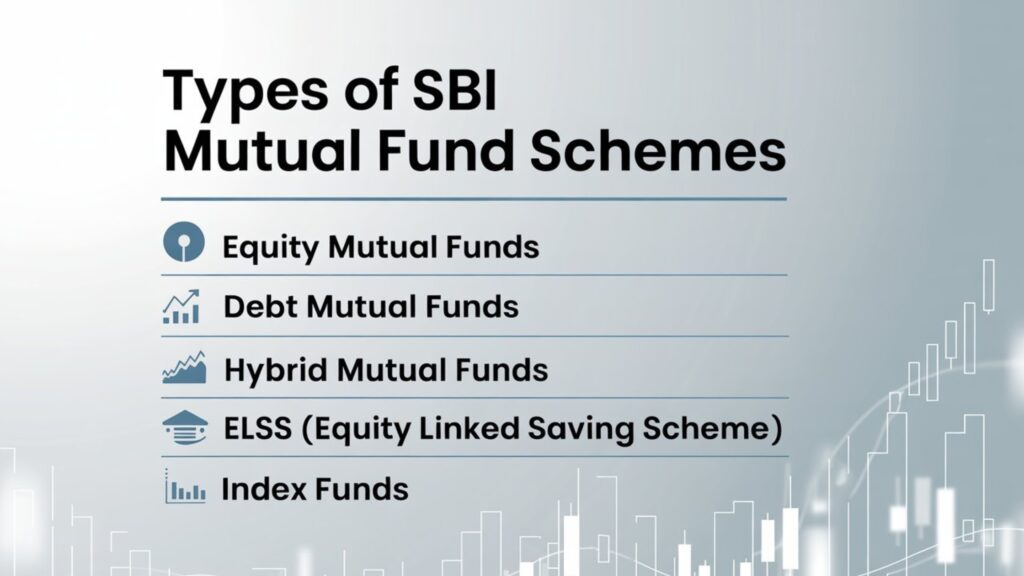

Types of SBI Fund Schemes

1. SBI Equity Mutual Funds

These are ideal for long-term growth as they invest primarily in equities (stocks). Suitable for aggressive investors.

2. SBI Debt Mutual Funds

These funds invest in fixed-income instruments like bonds, suitable for conservative investors seeking stable returns.

3. SBI Hybrid Mutual Funds

Combines equity and debt components. Balances risk and return. Great for moderate-risk investors.

4. SBI ELSS (Equity Linked Savings Scheme)

A tax-saving mutual fund under Section 80C with a lock-in period of 3 years. One of the most popular tax-saving options.

5. SBI Index Funds

Passive investment funds that mirror market indices like the Nifty or Sensex. Ideal for those seeking low-cost investing.

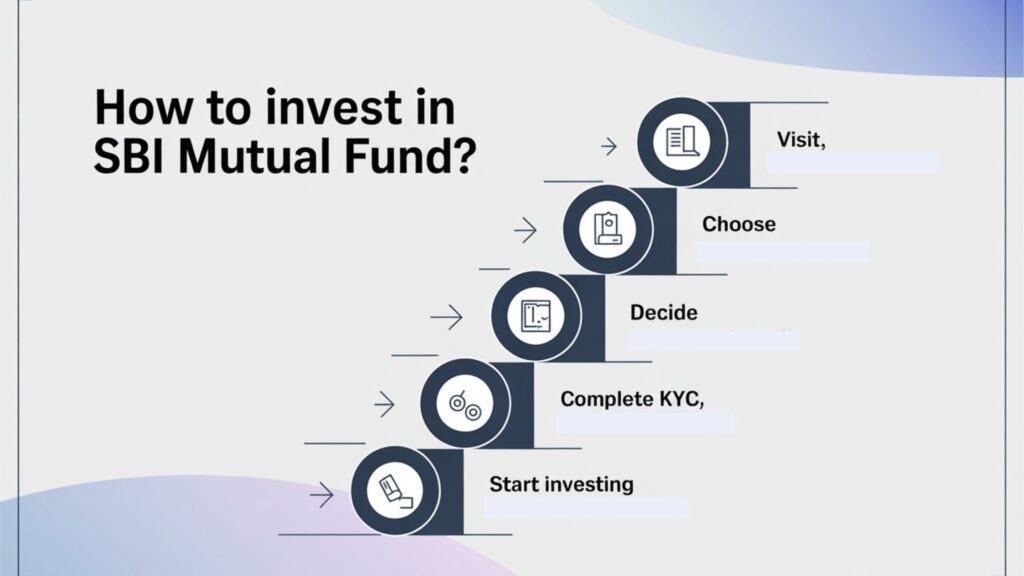

How to Invest in Mutual Fund?

Here’s a step-by-step guide:

- Visit the official SBI Funds website or a trusted platform.

- Choose the right fund based on your risk profile and goals.

- Complete KYC: Upload documents like PAN, Aadhaar, etc.

- Decide investment mode: Lump sum or SIP (Systematic Investment Plan).

- Start Investing via net banking, UPI, or debit mandates.

Pro Tip: Starting early through SIP in SBI Fund is a great way to build wealth over time.

Comparison: SBI Mutual-Fund vs Mutual-Funds in UAE

| Feature | SBI Mutual Fund | Mutual Funds in UAE |

|---|---|---|

| Regulation | SEBI (India) | UAE Securities & Commodities Authority |

| Popularity | High among Indian residents and NRIs | Popular among UAE residents, including expats |

| Minimum Investment | ₹500 (SIP) | Often AED 1000 or more |

| Tax Benefits | ELSS under 80C | No tax benefits in UAE due to 0% income tax |

| Fund Variety | Wide range of funds | Growing selection, focused on regional and global markets |

People Also Ask (PAA)

What is the minimum investment in SBI Mutual Funds?

You can start with as little as ₹500 per month through SIP or ₹1,000 as a lump sum, depending on the scheme.

Is SBI Mutual Fund safe?

Yes, it is regulated by SEBI and backed by the State Bank of India. However, all mutual fund investments are subject to market risks.

Can NRIs invest in SBI Funds?

Yes, Non-Resident Indians can invest in SBI Mutual-Fund through NRE/NRO accounts, with proper KYC documentation.

How to choose the best SBI Mutual Fund scheme?

Consider your goals, investment horizon, and risk appetite. Use tools like fund performance charts and risk meters on the SBI MF portal.

Related Terms People Also Search For

- Best Mutual Funds for SIP 2025

- SBI Small Cap Fund Review

- Mutual Investment Fund vs Mutual Fund

- Tax Saving Mutual Funds

- SIP vs Lump Sum Investment

- Bricks Consultancy – Mutual Funds in UAE

- How to Invest in Mutual Funds in UAE

What is a Mutual Investment Fund?

A Mutual Investment Fund is a professionally managed pool of money from many investors, invested in diversified assets like stocks, bonds, and other instruments. SBI Mutual Funds is an example of such a fund, where the goal is to offer capital appreciation, regular income, or both depending on the fund’s objective.

Key Differences Between SBI Mutual Fund and Mutual Investment Fund Globally

| Criteria | SBI Fund | Global Mutual Investment Fund |

|---|---|---|

| Base Location | India | Global (UAE, US, UK, etc.) |

| Fund Manager | SBI Funds Management Pvt. Ltd. | Varies (BlackRock, Vanguard, etc.) |

| Regulation | SEBI | Local market regulators (e.g., SEC, FCA, SCA) |

| Currency | INR | Varies (AED, USD, GBP) |

| Tax Implication | India Tax Laws | Depends on the country |

SBI Mutual Fund for NRIs and UAE Investors

If you’re living in the UAE and looking for diversified investment options, combining SBI Investment Schemes schemes with Mutual Funds in UAE can help you balance global exposure and home-country investments. Many investors use platforms like Bricks Consultancy to explore hybrid strategies involving both Indian and UAE-based mutual funds.

Benefits of SBI Mutual Fund

- Trusted brand backed by SBI

- Wide variety of fund categories

- Options for tax-saving (ELSS)

- Accessible investment with low minimums

- Great for SIP and long-term goals

- Professional fund management

- Suitable for both Indian residents and NRIs

Conclusion

In 2025, investing in SBI Mutual Fund remains a wise choice for both beginners and seasoned investors. With a mix of safety, growth, and accessibility, it caters to diverse financial needs. Whether you’re comparing with Mutual Funds in UAE or exploring a Mutual Investment Fund globally, SBI MF holds its ground as a powerful wealth-building tool.

If you’re serious about growing your wealth, it’s time to explore SBI Funds and make informed investment choices that secure your financial future.

Need expert guidance tailored to your goals? Connect with financial experts at Bricks Consultancy and start your smart investment journey today.