<!-- Google tag (gtag.js) --> <script async src="https://www.googletagmanager.com/gtag/js?id=G-FNVKYB7G4T"></script> <script> window.dataLayer = window.dataLayer || []; function gtag(){dataLayer.push(arguments);} gtag('js', new Date()); gtag('config', 'G-FNVKYB7G4T'); </script>

Are you tired of market volatility eating away at your savings? Imagine growing your wealth consistently without timing the market. That’s exactly what a Systematic Investment Plan (SIP) offers. With more investors in the UAE choosing SIPs to build long-term wealth, it’s time you understand why this method has become a preferred investment plan in UAE—especially when paired with solid financial products like Life Insurance Dubai.

In this blog, you’ll discover the essentials of SIPs, how they work, different types, benefits, and how to get started effectively.

What is a Systematic Investment Plan?

A Systematic Investment Plan (SIP) is a disciplined method of investing in mutual funds. It enables investors to contribute a fixed amount at regular intervals (e.g., monthly or quarterly), offering a structured approach to wealth creation.

Key Features:

- Regular and automated investing

- Low entry amount (as low as AED 100)

- Designed for long-term capital growth

- Minimizes the risk of market timing

SIPs are especially beneficial for those who seek steady investment without needing to actively monitor the market.

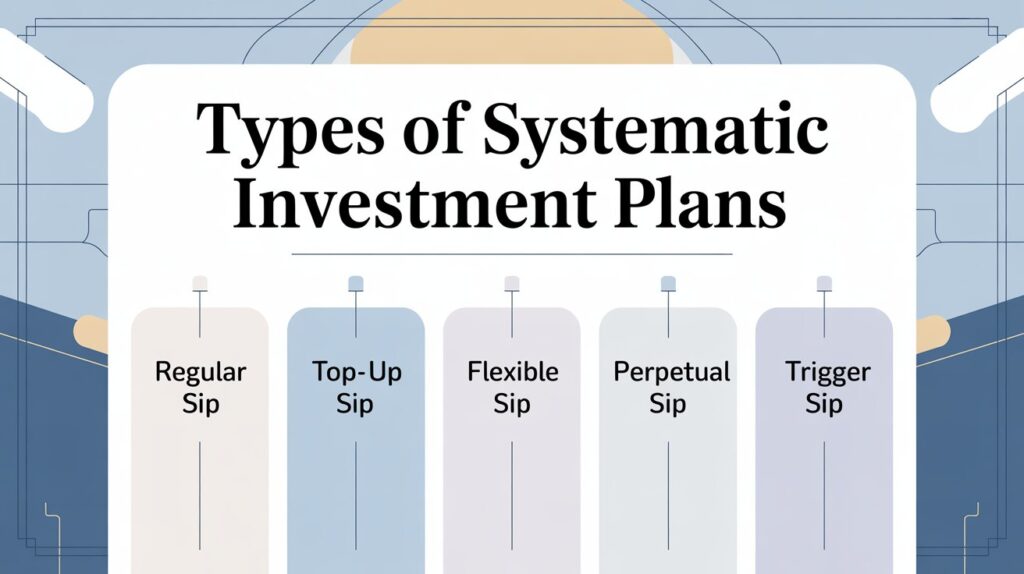

Types of Systematic Investment Plans

There are several types of SIPs, each catering to different financial goals and investment styles:

1. Regular SIP

Invest a fixed amount periodically (monthly or quarterly). Ideal for salaried individuals.

2. Top-up SIP

Allows increasing your investment amount periodically to match rising income or inflation.

3. Flexible SIP

Investors can vary the amount based on their cash flow, offering greater control over finances.

4. Perpetual SIP

No fixed end date; continues until you choose to stop it. Good for long-term wealth accumulation.

5. Trigger SIP

Investments are triggered by specific events (e.g., NAV price, date, or index level). Suitable for advanced investors.

Understanding the type of SIP is essential to align your plan with personal financial goals and risk tolerance.

7 Proven Benefits of a Systematic Investment Plan

1. Rupee Cost Averaging

SIPs purchase more units when prices are low and fewer when prices are high, reducing the average cost per unit over time.

2. Power of Compounding

Returns earned are reinvested, enabling exponential wealth accumulation with time.

3. Budget-Friendly Investment

SIPs allow you to start with a small amount, making it accessible for all income levels.

4. Financial Discipline

Automatic investments ensure consistent saving and instill a habit of budgeting.

5. Flexibility and Convenience

SIPs can be paused, modified, or stopped without significant penalties.

6. Goal-Based Planning

Great for meeting financial milestones like buying a house, funding education, or retirement.

7. Tax Efficiency

Depending on the fund type, SIPs can offer tax advantages such as exemptions under ELSS schemes.

SIP vs. Lump Sum Investment: A Comparison

| Criteria | Systematic Investment Plan | Lump Sum Investment |

|---|---|---|

| Market Timing Risk | Low | High |

| Affordability | High (starts low) | Requires large capital |

| Financial Discipline | High | Low |

| Risk Mitigation | Averaged over time | Depends on market entry |

| Convenience | Auto-debit, easy to set up | One-time effort |

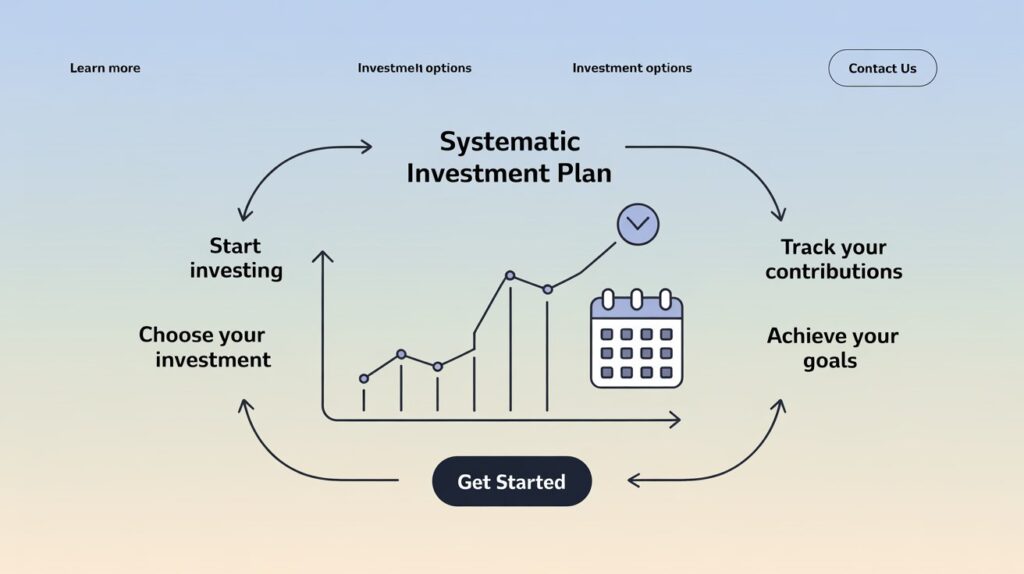

How to Start a Systematic Investment Plan in UAE

- Set clear financial goals – short-term or long-term (education, retirement, etc.)

- Evaluate your risk tolerance – conservative, moderate, or aggressive

- Select a mutual fund – choose equity, debt, or hybrid based on your objective

- Choose the SIP type – regular, top-up, flexible, etc.

- Decide the investment amount and frequency

- Open an investment account – through a bank or certified financial advisor

- Automate and monitor – schedule auto-debit and review performance regularly

Many investors in the UAE pair SIPs with Life Insurance Dubai to create a balanced financial portfolio that includes both investment and protection.

Tips to Maximize SIP Returns

- Start early to benefit from long-term compounding

- Avoid skipping installments

- Use top-up SIPs to increase contributions over time

- Diversify across different mutual fund categories

- Review and realign your SIPs annually

SIP and Market Volatility

SIPs are particularly effective during volatile markets. They average the cost of investment and eliminate emotional decision-making, providing a safer route for long-term investors.

Even during market downturns, continuing SIPs ensures lower purchase costs, which leads to better returns when the market recovers.

Real-Life Example: SIP in Action

Scenario: Ali started a SIP of AED 1,000 per month in a balanced mutual fund with an average annual return of 10%. After 10 years, his total investment of AED 120,000 grew to nearly AED 200,000 due to compounding returns.

Insight: Despite occasional market drops, consistent investment and compounding led to significant wealth growth.

FAQ: People Also Ask

What is a Systematic Investment Plan and why is it important?

A SIP is an automated way of investing in mutual funds. It is important because it fosters disciplined investing and reduces risks associated with market timing.

How does a Systematic Investment Plan work?

You invest a fixed amount at set intervals into a mutual fund. The amount buys fund units based on current NAV, building wealth gradually over time.

Is SIP better than lump sum investment?

Yes, especially for regular income earners. SIPs reduce market risk and help build wealth with smaller, consistent contributions.

Can I stop or modify my SIP?

Yes. SIPs are highly flexible. Investors can pause, stop, or change the amount anytime.

What are the best funds for SIP in the UAE?

Popular choices include global diversified funds, Islamic funds, and local equity funds. It’s best to consult a licensed advisor for specific recommendations.

Related Insights (People Also Search For)

- Investment Plan in UAE

- Mutual Funds for Beginners

- SIP vs Fixed Deposit

- Life Insurance Dubai

- Financial Planning for Expats

- Long-Term Investment Strategies

Testimonials

“After starting my SIP two years ago, I’ve seen steady growth despite market fluctuations. It’s perfect for my long-term goals.” – Fatima Al Suwaidi, Business Owner, Dubai

“Combining SIP with Life Insurance Dubai gave me peace of mind. I know my family is covered while I build wealth.” – Aamir Sheikh, Engineer, Abu Dhabi

“Thanks to SIPs, I now follow a disciplined saving habit. I even use it to fund my child’s future education.” – Neha Kapoor, HR Manager, Sharjah

Conclusion

A Systematic Investment Plan is an ideal investment method for anyone looking to create long-term wealth without getting overwhelmed by market fluctuations. Its disciplined, flexible, and goal-oriented approach makes it a preferred investment plan in UAE for both new and experienced investors.

By combining SIPs with risk-mitigation tools like Life Insurance Dubai, you not only build wealth but also safeguard your future.

If you haven’t started your SIP yet, now is the time. Consult a financial advisor, pick the right plan, and invest consistently. The earlier you begin, the better the results.

Ready to start your SIP journey with expert guidance?

Visit Bricks Consultancy — your trusted partner in financial planning across the UAE. Get personalized advice, tailored plans, and end-to-end support to secure your future.