<!-- Google tag (gtag.js) --> <script async src="https://www.googletagmanager.com/gtag/js?id=G-FNVKYB7G4T"></script> <script> window.dataLayer = window.dataLayer || []; function gtag(){dataLayer.push(arguments);} gtag('js', new Date()); gtag('config', 'G-FNVKYB7G4T'); </script>

When planning for the future, life insurance is a crucial part of financial security. Among the various options available, term life insurance stands out for its simplicity, affordability, and effectiveness. Whether you’re safeguarding your family’s future or managing your financial obligations, understanding this type of insurance can help you make informed decisions. It’s also widely recommended by experts in Financial Services Dubai as part of a solid protection plan.

Table of Contents

What Is Term Life Insurance?

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. If the policyholder passes away during this term, the beneficiary receives a death benefit. This type of policy is known for being straightforward and cost-effective, with no investment component or cash value.

Key Attributes:

- Fixed-term coverage

- Affordable premiums

- No savings or investment features

- Designed for financial protection during specific life stages

Major Benefits about term life insurance You Should Know

Term coverage is often selected for its many advantages:

- Lower Premiums: Compared to permanent policy, premiums are generally much lower.

- Clarity: The structure is simple and easy to understand.

- Flexibility: You can choose a term that matches your needs.

- Tax Efficiency: Payouts are typically tax-free.

- Adaptability: Some policies can be converted to permanent plans later.

These benefits make it a favored solution for residents and expats alike, especially in financial hubs like Dubai.

Comparison: Term life insurance vs Whole Life Insurance

| Feature | Term Life | Whole Life |

|---|---|---|

| Duration | Limited term | Lifelong |

| Premiums | Generally lower | Higher |

| Cash Value | No | Yes |

| Investment Option | No | Yes |

| Use Case | Temporary need | Long-term estate planning |

Who Should Consider It?

This insurance is ideal for individuals who:

- Are supporting a young family

- Have outstanding loans or mortgages

- Need financial protection for a limited time

- Want a straightforward, cost-effective solution

- Are expats in the United Arab Emirates looking for quick coverage options

Many financial advisors in Financial Services Dubai suggest this option as a foundational element of a personal protection strategy.

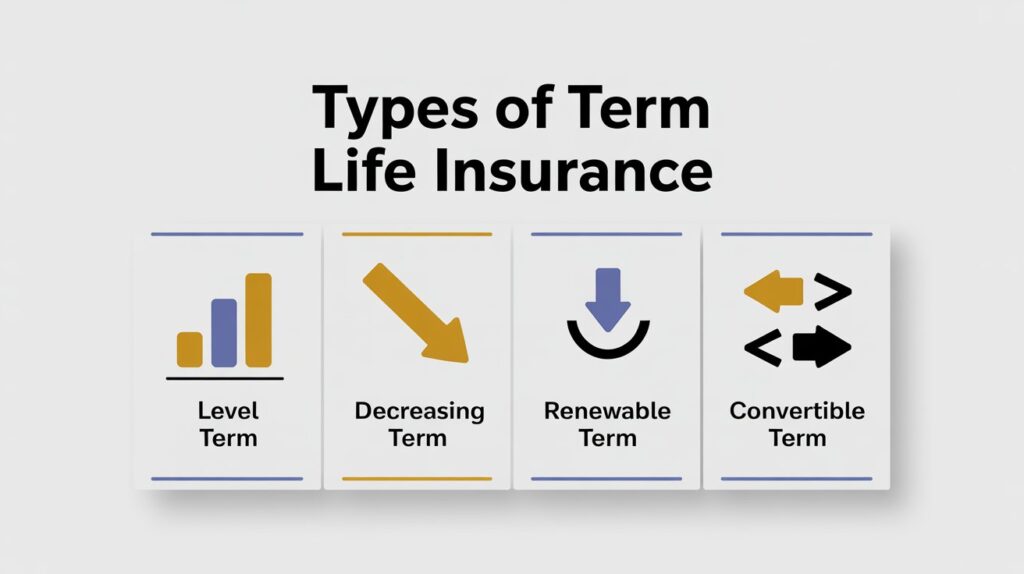

Types of Term life insurance

Different versions are available depending on your needs:

Level Term

Premiums and coverage remain constant throughout the term.

Decreasing Term

The death benefit reduces over time, often aligning with a loan payoff schedule.

Renewable Term

Lets you renew coverage at the end of the term, usually with higher premiums.

Convertible Term

Offers the option to switch to a permanent policy without a new medical exam.

How to Estimate Coverage Needs

To determine how much coverage you need, consider your:

- Annual income

- Outstanding debts

- Mortgage balance

- Future education costs

- Existing savings

One useful approach used by professionals is the DIME method: Debt, Income, Mortgage, and Education.

Application Process Simplified

Here’s how the process usually works:

- Evaluate your financial needs

- Compare quotes and features

- Complete an application

- Take a medical exam (if required)

- Review and finalize the policy

This step-by-step flow is also supported by many providers involved in Financial Services Dubai, who offer tailored packages for local and expat clients.

Common Questions Answered (People Also Ask)

Is term coverage worth it?

Yes. It provides affordable and adequate financial protection for those who need it for a specific time period.

What happens if the term ends?

The policy expires. You can choose to renew it or convert it to another form of insurance if your plan allows.

Can non-residents in the UAE buy it?

Yes, most international insurers offer flexible solutions, particularly in investment-friendly regions.

Is the payout taxable?

In most cases, the benefit is paid out tax-free to your beneficiaries.

Related Topics (People Also Search For)

- Short-term life policies

- Financial planning for expats

- Income protection options

- Family protection strategies

- Best Investment in UAE

- UAE life cover regulations

A Smart Addition to UAE Investment Plans

If you’re evaluating the Best Investment in UAE, it’s not just about returns. Protection-based tools like this life cover provide emotional and financial security, which is priceless. The low-cost nature and high impact of a term plan make it a smart complement to traditional investments such as real estate or savings plans.

Real Voices: Testimonials from Policyholders

“Choosing term life insurance was one of the smartest decisions I’ve made. The affordability and clarity helped me secure my family’s future without financial strain. Highly recommend it to anyone working with Financial Services Dubai.”

— Nadia M., Dubai Marina

“As an expat, I needed a solution that fits my lifestyle and budget. My advisor helped me pick a policy that balances protection with flexibility. It’s truly one of the Best Investments in UAE for family peace of mind.”

— Rajesh P., Abu Dhabi

“I was skeptical at first, but after understanding the benefits and the straightforward structure of term coverage, I was convinced. It’s reliable, and my premiums are affordable—even with long-term protection.”

— Sarah K., Business Bay

“I appreciated how my provider simplified the entire application process. Term life insurance gave me the security I needed at a price that didn’t hurt my budget.”

— Mohamed A., Jumeirah Lake Towers

These testimonials reflect the real-world benefits experienced by individuals who prioritized future planning with the right financial tools.

Why Dubai Professionals Recommend It

Financial advisors in Dubai often suggest adding this insurance to any well-rounded plan because:

- It’s flexible and scalable

- Suitable for high-income and budget-conscious clients alike

- Supports long-term financial goals

- Can be adjusted to match local and global requirements

Final Thoughts

In summary, term life insurance is a powerful tool for those looking to protect their loved ones and manage future risk. It offers flexibility, affordability, and peace of mind—key factors in any responsible financial strategy. If you’re in the UAE or working with specialists in Financial Services Dubai, this could be the perfect time to explore how term life insurance fits into your long-term plans.

Ready to take the next step? Connect with expert advisors at Bricks Consultancy — your trusted partner in financial planning and protection. Whether you’re seeking the Best Investment in UAE or a customized insurance solution, they’ll help you secure your future with confidence.