<!-- Google tag (gtag.js) --> <script async src="https://www.googletagmanager.com/gtag/js?id=G-FNVKYB7G4T"></script> <script> window.dataLayer = window.dataLayer || []; function gtag(){dataLayer.push(arguments);} gtag('js', new Date()); gtag('config', 'G-FNVKYB7G4T'); </script>

Living and working in the UAE offers endless opportunities, but what happens if you unexpectedly lose your job? That’s where UAE Unemployment Insurance becomes a financial safety net. This essential program is designed to protect both Emiratis and expats by offering monetary support during unforeseen employment gaps. In this blog, we’ll dive deep into how it works, who qualifies, and why it’s crucial in today’s evolving job market. Whether you’re an employee or a business owner, understanding UAE Unemployment Insurance can safeguard your future.

Table of Contents

What is UAE Unemployment Insurance?

UAE Unemployment Insurance is a government-mandated scheme launched to provide financial compensation to employees who lose their jobs due to reasons beyond their control. Officially known as the “Involuntary Loss of Employment (ILOE)” system, this initiative ensures temporary income stability.

Key Features:

- Monthly cash benefit for up to 3 months

- Available for both UAE nationals and expatriates

- Mandatory for all employees in the private and federal government sectors

Why UAE Unemployment Insurance Matters in 2025

Unemployment is never planned, but its impact can be managed. Here’s why this scheme is a game-changer:

- Protects against sudden income loss

- Boosts confidence in UAE’s workforce policies

- Promotes social and financial stability

The initiative also complements long-term savings goals like the Best SIP in UAE, ensuring your investments aren’t interrupted due to temporary job loss.

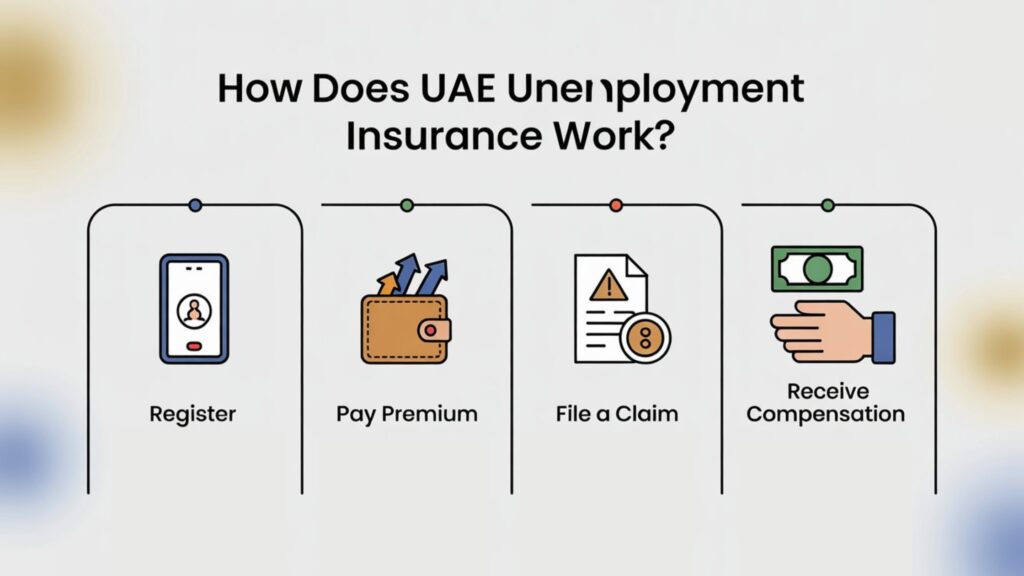

How Does UAE Unemployment Insurance Work?

The system is simple yet effective. Here’s a step-by-step breakdown:

Step-by-Step Process:

- Register through official platforms (app/website).

- Pay a monthly premium based on your salary bracket.

- File a claim within 30 days of job loss.

- Receive compensation of up to 60% of your salary for a maximum of 3 months.

Eligibility Criteria

To qualify, you must meet the following:

- Employed in UAE (public or private sector)

- Employed for minimum 12 consecutive months

- Terminated due to reasons not related to disciplinary action

- Must have an active ILOE policy for at least 12 months

Premium and Compensation Structure

Here’s a quick comparison of the two income brackets and their corresponding premiums:

| Monthly Salary | Monthly Premium | Max Monthly Compensation |

|---|---|---|

| AED 16,000 or less | AED 5 | AED 10,000 |

| AED 16,001+ | AED 10 | AED 20,000 |

Note: Compensation is capped and paid for a maximum of three months per claim.

7 Things You Should Know About UAE Unemployment Insurance

- Mandatory for Employees – Failure to register incurs fines.

- Flexible Registration – Can be done via the ILOE app, website, kiosks, or banks.

- Short Waiting Period – Just 12 months of enrollment to claim.

- No Coverage for Disciplinary Dismissals – Misconduct disqualifies you.

- Supports Career Transition – Helps you stay afloat while job hunting.

- Separate from Gratuity or End-of-Service Benefits

- Part of Broader Wealth Strategy – Aligns with long-term plans like the Best SIP in UAE and services offered by wealth management companies in Dubai.

Who Manages the Scheme?

The scheme is managed by Dubai Insurance Company on behalf of the UAE Ministry of Human Resources and Emiratisation (MOHRE). It involves a pool of nine insurance providers to offer broad and secure coverage.

Benefits of Enrolling

Financial Security

Get up to 60% of your basic salary if you lose your job.

Peace of Mind

Focus on finding a new job rather than stressing over immediate bills.

Encourages Savings

Supports larger wealth goals with consistent financial planning. Services from wealth management companies in Dubai often integrate such schemes into holistic advisory.

Real-Life Experience

Ali Raza, an IT professional in Dubai, shared:

“When I was unexpectedly let go during company restructuring, my unemployment insurance gave me breathing room to search for a new job. The three months’ payout kept me stable.”

Neha Sharma, HR Executive:

“We make sure all our employees are enrolled. It boosts morale and builds trust within the company.”

James O’Connor, expat from the UK:

“This policy feels like a cushion. Combined with my SIP investments and the advice I get from a top wealth management company in Dubai, I feel secure.”

Pros of UAE Unemployment Insurance

- Affordable monthly premiums

- Legal obligation, so future-proofing your finances

- Quick payout timeline

- Works with other financial plans like Best SIP in UAE

- Mandatory compliance promotes a fairer workforce

FAQs About UAE Unemployment Insurance

1. Who must register for UAE Unemployment Insurance?

All public and private sector employees must register unless exempted (e.g., investors, domestic workers, minors under 18).

2. Can I cancel my policy if I leave the UAE?

Yes. Cancelation can be done through the portal/app. However, no refund is offered on unused premiums.

3. Is UAE Unemployment Insurance the same as health insurance?

No. It covers income loss, not medical expenses. Both are separate and mandatory.

4. What happens if I don’t register?

You’ll be fined AED 400 for non-enrollment and AED 200 for missing premium payments.

5. Can I claim more than once?

Yes, but only once every 12 months, and your policy must remain active and premium payments up-to-date.

Related Insights (People Also Search For)

- Job loss protection UAE

- Involuntary Loss of Employment insurance

- ILOE UAE rules

- Employment benefits in UAE

- Best SIP in UAE

- Wealth management companies in Dubai

Conclusion

In today’s uncertain economic climate, UAE Unemployment Insurance is not just a legal requirement—it’s a vital financial tool. It supports employees with a lifeline during job transitions, protects long-term wealth strategies like the Best SIP in UAE, and complements the guidance offered by top wealth management companies in Dubai. If you’re working in the UAE, take this seriously—enroll today, and give yourself the financial security you deserve.

Ready to secure your future?

Make UAE Unemployment Insurance your first step toward stability and smart financial planning.

Need expert guidance? Connect with the professionals at Bricks Consultancy for personalized financial solutions, investment strategies, and trusted advice tailored to your goals.